ST. GEORGE’S, NEWFOUNDLAND AND LABRADOR / ACCESS Newswire / September 30, 2025 / Atlas Salt Inc. (“Atlas Salt” or the “Company”) (TSXV:SALT)(OTCQB:REMRF)(FRA:9D00) announces the results of its Updated Feasibility Study (“UFS”) on the 100%-owned Great Atlantic Salt Project (“Great Atlantic” or the “Project”) located in Western Newfoundland.

UFS Highlights

(all figures are in Canadian dollars and include annual escalation, unless otherwise noted)

-

Post-tax NPV 8 : $920 million, Post-tax IRR: 21.3%, Payback: 4.2 Years

-

Pre-tax NPV 8 : $1.68 billion, Pre-tax IRR : 27.1%

-

Pre-tax NPV 5 : $2.75 billion, Post-tax NPV 5 : $1.57 billion

-

-

Initial Capital Cost : $589 million

-

Life of Mine (“LOM”) Sustaining Capital : $609 million

-

Average Annual LOM Operating Cashflow (EBITDA 1 ) in Operations : $325 million per annum (“pa”)

-

Average Annual LOM Post-Tax Free Cashflow in Operation : $188 million pa

-

Total Undiscounted Post-Tax Cashflow (including Initial Capital Cost) : $3.93 billion

-

Average Annual Steady State Production LOM : 4.0 million tonnes of high-purity road salt

-

Mine Life : 24 years based on Proven and Probable Reserves

-

Average Operating Cost : $28.17 per tonne free on board (“FOB”) mine site port

-

Production Rate : 4.0 million tonnes per annum (“Mtpa”)

-

Port Capacity : Designed for scalable throughput up to 4.0 Mtpa

1 EBITDA is a non ‑ International Financial Reporting Standards (“IFRS”) financial measure and represents earnings before interest, income taxes, depreciation and amortization. It is not defined under IFRS and may not be comparable to similar measures presented by other companies. Management believes that this measure provides useful supplemental information to investors in evaluating the Project’s operating performance and its ability to generate cash flows. EBITDA is closely approximated in this model by Operating Cashflow, defined as Net Revenues less cash operating costs.

Nolan Peterson, CEO and Director of Atlas Salt, stated : “The Updated Feasibility Study marks another significant milestone in Atlas Salt’s journey, highlighting Great Atlantic’s potential as the leading undeveloped salt project in North America. This study reinforces our vision to deliver a long-life, low-cost operation at scale. It is supported by technical and logistical enhancements from the 2023 Feasibility Study that further reduce risks and position us for future success.

The improvement in projected free cash flow is especially significant as it validates the strengthened economics of Great Atlantic and enhances lender confidence in financing this world-class development. With the previously announced regulatory approval of our Early Works Development Plan, Atlas Salt is strategically positioned to advance Great Atlantic and create substantial value for all stakeholders.

We extend our gratitude to our employees, partners, the town of St. George’s and the broader Western Newfoundland community, and our dedicated shareholders for their ongoing support and commitment as we complete the UFS and move forward with our plans. Their belief in Atlas Salt drives our progress. With the foundation we have built, and the momentum of this updated feasibility study, we look forward with confidence to realizing Great Atlantic’s potential to help shape the future of salt supply in North America.”

Summary of Updated Feasibility Study

The UFS was prepared by SLR Consulting (Canada) Ltd. (“SLR”), with contributions from specialized engineering and technical partners including Shaft and Tunnel Consulting Services Ltd., Terrane Geoscience Inc., Sandvik Mining and Rock Solutions (“Sandvik”), and Tamarack Resources.

The Updated Feasibility Study builds on the 2023 Feasibility Study (“2023 FS”), incorporating optimizations in mine design, throughput, port logistics, and capital efficiency. The results confirm Great Atlantic as a large scale, high-purity, low-cost underground salt project strategically positioned to serve the North American market.

General Description of Operations and Process Plan

The capital and operating cost estimates in the Updated Feasibility Study have been prepared in accordance with the guidelines of the Association for the Advancement of Cost Engineering (AACE) for a Class 3 estimate. This level of estimate is typically based on feasibility-level engineering, vendor quotations, and discipline-level design sufficient to support a financing decision. The accuracy range for initial capital costs is considered to be within approximately -10% to +30%, while the accuracy for operating costs is estimated to be within approximately -10% to +20%. Costs are based on Q3 2025 data.

The estimates incorporate contingency allowances to reflect the current design, anticipated execution risks, and prevailing market conditions for labour, materials, and equipment. They are also benchmarked against comparable projects and historical data for underground salt operations.

Table 1 – Summary of UFS Economic Results and Assumptions 2

|

UFS Economic Model Results and Assumptions |

Value |

|

2025 Salt Price Assumed ($/t) |

$81.67 / t FOB port. |

|

Pre-Tax NPV₈ & IRR ($/%) |

$1.68 billion / 27.1 % |

|

Post-Tax NPV₈ & IRR ($/%) |

$920 million / 21.3% |

|

Undiscounted Post-Tax Cashflow (LOM) ($) |

$3.93 billion |

|

Average LOM Operating Cashflow (EBITDA 1 ) ($/a) |

$325 million |

|

Average LOM Post-Tax Cashflow ($/a) |

$188 million |

|

Post-Tax Payback Period (from first production) |

4.2 years |

|

Initial Capital ($) |

$589 million |

|

LOM Sustaining Capital ($) |

$609 million |

|

Average LOM Operating Cost (FOB port) ($/t) |

$28.17 / t |

|

Average Annual Steady-State Salt Production (Mtpa) |

4.0 Mt |

|

Life of Mine (LOM) (Years) |

24 years |

|

Total Tonnes Produced / Sold (LOM) (Mt) |

90.3 Mt |

|

Estimated Reserve Grade (% NaCl) |

95.9 % NaCl |

2 Unless otherwise noted, values are presented in Canadian dollars and expressed in real terms as of 2025. Certain figures (e.g., NPV, IRR, payback) are derived outputs of the discounted cash flow model rather than direct 2025-dollar inputs. The salt price assumption is stated in 2025 Canadian dollars FOB mine site port facility. Salt pricing was determined by an independent third-party marketing study. The port facility is assumed to be operated by a third-party contractor, with associated costs incorporated into the economic analysis.

Summary of Strategic & Technical Advancements in UFS

-

Optimized Production Plan – Incorporates updated geotechnical, ventilation, and infrastructure studies to support efficient construction and long-term operations.

-

EquipmentIntegration – Deployment of Sandvik continuous mining equipment to improve productivity and reduce unit operating costs.

-

Port& Logistics Improvements – Upgraded stockpile and shiploading configurations to support high-capacity, efficient loading.

-

EconomicResilience – Financial model reflects updated costs, pricing assumptions (including inflationary trends), and robust project economics.

-

RegulatoryAlignment – Incorporates all post-Environmental Assessment release conditions, ensuring compliance.

These changes collectively demonstrate improved project resilience and stronger cash flow generation and returns potential, while further de-risking execution.

Detailed Comparison to 2023 Feasibility Study

Atlas Salt has summarized the quantitative differences between the 2023 Feasibility Study (“2023 FS”) and the Updated Feasibility Study (“UFS”). Unless otherwise noted, figures are presented as LOM totals or averages.

Table 2 – Detailed Comparison to 2023 Feasibility Study

|

Metric |

2023 FS |

2025 UFS |

Variance (Abs.) |

Variance (%) |

|

Production Rate (Mtpa) |

2.5 |

4.0 |

+1.5 |

+60% |

|

Mine Life (years) |

34 |

24 |

(10) |

(29.5%) |

|

Tonnes Produced / Sold (LOM, Mt) |

83.7 |

90.3 |

+6.6 |

+8% |

|

Salt Price (FOB port, $/t, LOM Average) |

$124.86 |

$118.49 |

($6.37) |

(5%) 3 |

|

Operating Cost ($/t) |

$27.49 |

$22.00 |

($5.49) |

(20%) 4 |

|

Pre-tax NPV8 ($M) |

$1,017 |

$1,683 |

+$666 |

+65% |

|

After-tax NPV8 ($M) |

$553M |

$920M |

+367M |

+66% |

|

Average LOM Operating Cashflow in Operation (EBITDA 1 ) $M/a |

$211M |

$315M |

+$104M |

+49% |

|

Average LOM Post-Tax Cashflow in Operation $M/a |

$121M |

$188M |

+$67M |

+55% |

|

Post-tax IRR (%) |

18.5% |

21.3% |

+2.8% |

+15% |

|

Initial Capital ($M) |

$480M |

$589M |

+$109M |

+23% |

|

Sustaining Capital (LOM, $M) |

$600M |

$609M |

+$9M |

+2% |

|

Payback Period (years) |

4.8 |

4.2 |

(0.6) |

(12%) |

|

Post-Tax NPV 8 / Initial CAPEX Ratio |

1.15 |

1.56 |

+0.41 |

+36% |

[3] From shorter overall mine life

[4] From shorter overall mine life and economies of scale

UFS Technical Summary

Project Location and Access

The Great Atlantic Salt Project is located near St. George’s, Newfoundland, approximately 3 km from the Trans-Canada Highway and adjacent to deepwater port facilities on the west coast of Newfoundland. The location provides direct access to tidewater shipping routes serving Eastern Canada, the U.S. Northeast and Western Europe.

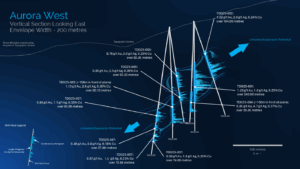

Geology and Mineral Resources

The Great Atlantic deposit is a flat-lying, laterally extensive, high-purity halite formation with minimal insoluble content. No changes were made to the Mineral Resource estimate completed in the 2023 FS. Table 3 provides a summary of the Mineral Resource estimate by SLR, with an effective date of September 30, 2025.

Table 3 – Mineral Resource Estimate – September 30, 2025

|

Category |

Horizon |

Tonnes (Mt) |

Grade (% NaCl) |

Contained NaCl (Mt) |

|

Indicated |

1-Salt |

– |

– |

– |

|

2-Salt |

160 |

95.9 |

154 |

|

|

3-Salt |

223 |

96.0 |

214 |

|

|

Total |

383 |

96.0 |

368 |

|

Inferred |

1-Salt |

195 |

95.3 |

186 |

|

2-Salt |

288 |

95.3 |

274 |

|

|

3-Salt |

385 |

95.0 |

366 |

|

|

Total |

868 |

95.2 |

827 |

Notes:

-

CIM (2014) definitions were followed for Mineral Resources.

-

Mineral Resources are estimated without a reporting cut-off grade. Reasonable Prospects for Eventual Economic Extraction were instead demonstrated by reporting within Mineable “Stope” Optimised (MSO) shapes, with a minimum height of 5 m, minimum width of 20 m, length of 40 m, and minimum grade of 90% NaCl, with a 5 m minimum pillar width between shapes.

-

Bulk density is 2.16 t/m 3 .

-

Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

-

Mineral Resources are inclusive of Mineral Reserves.

-

Salt prices are not directly incorporated into the Mineral Resource MSO minimum target grades, however, the mean Mineral Resource grades exceed the 95.0% NaCl (± 0.5%) specification outlined in ASTM Designation D632-12 (2012).

-

Numbers may not add due to rounding.

The Updated Feasibility Study uses the same Mineral Resource estimate completed in the 2023 FS. There have been no changes to the Mineral Resource estimate between the 2023 FS and the UFS (2025). The Mineral Resource estimate has a new effective date of September 30, 2025.

Mineral Reserves

The Updated Feasibility Study is supported by the Mineral Reserve estimate summarized in Table 4. These Probable Reserves have been prepared in accordance with NI 43-101 and reflect appropriate modifying factors for mining, recovery, and economics at a feasibility study level. The Mineral Reserves have an effective date of September 30, 2025.

Table 4 – Summary of Mineral Reserves

|

Category |

Horizon |

Tonnes (Mt) |

Grade (% NaCl) |

Contained NaCl (Mt) |

|

Probable |

2-Salt |

39.3 |

95.9 |

37.6 |

|

3-Salt |

55.8 |

95.9 |

53.5 |

|

|

Total |

All |

95.0 |

95.9 |

91.1 |

|

Notes:

|

Table 5 compares the Probable Reserves from the 2023 FS with the current UFS.

Table 5 – Mineral Reserve Comparison

|

Category |

Horizon |

2023 FS Reserves |

2025 UFS Reserves |

Variance (Abs.) |

Variance (%) |

|

Probable (Mt) |

2-Salt |

37.7 Mt @ 95.9% NaCl |

39.3 Mt @ 95.9% NaCl |

1.5 Mt |

+4.1% |

|

3-Salt |

50.3 Mt @ 96.0% NaCl |

55.8 Mt @ 95.9% NaCl |

5.4 Mt |

+10.8% |

|

|

Total |

88.1 Mt @ 96.0% NaCl |

95.0 Mt @ 95.9% NaCl |

7.0 Mt |

+7.9% |

The changes are principally related to different pillar and room dimensions, and minor variances in level spacing.

Mining Method and Design

-

Method : Room-and-pillar underground mining using continuous miners.

-

PillarConfiguration : Designed for long-term stability, with pillar dimensions and sequencing optimized for maximum extraction while ensuring ground control.

-

Development : Access via surface portal and conveyor decline system; mine layout configured for scalable expansion.

-

ProductionRate : 4.0 Mtpa steady-state by Year 4, with ramp-up commencing in Year 1.

-

Daily Production Rate: Approximately 11,500 tonnes per day at steady-state capacity.

Processing and Product Handling

Salt is crushed and screened underground to market specifications, conveyed to surface, and transported to the port via covered conveyor. No chemical processing or water usage in processing is required, other than the application of an anti-caking agent immediately prior to shipment offsite.

Infrastructure and Logistics

-

Port : Dedicated port storage and shiploading system designed for 4.0 Mtpa throughput at full operations.

-

Shiploading : Continuous conveyor-fed shiploader with optimized cycle times to minimize vessel demurrage.

-

Storage : Surface stockpile capacity of approximately 72 kt, equivalent to 6.5 days of average production.

-

Utilities : Connection to provincial power grid with dedicated substation;

-

Power: The Project is expected to require approximately 10 megawatts (MW) of connected load at steady-state operations, sourced from the provincial grid via a dedicated substation.

-

Accommodation: No camp facilities are included in the design, with the Project benefiting from proximity to established communities and existing regional infrastructure.

Operating Costs

The operating cost estimates were developed from first principles using a combination of vendor quotations, budgetary pricing from equipment suppliers, labour and power cost assumptions specific to Newfoundland, and benchmarking against comparable underground salt operations. Mining, processing, and port handling costs reflect the planned use of continuous miners, conveyor haulage, and high-capacity shiploading infrastructure. General and administrative (G&A) costs are based on staffing requirements and site services, while closure and bonding provisions reflect anticipated regulatory obligations. Costs are expressed on a LOM average basis and are considered accurate to within -10% to +20%, consistent with a feasibility-level estimate.

Table 6 – Operating Cost Summary Table

|

Item |

Total Operating Cost ($M) |

Unit Operating Cost ($/t) |

|

Mining |

$1,354M |

$15.00 |

|

Processing & Handling |

$297M |

$3.29 |

|

G&A |

$335M |

$3.71 |

|

Port Operations |

$557M |

$6.17 |

|

Total |

$2,543M |

$28.17 |

Capital Costs

The initial capital cost for the Great Atlantic Salt Project is estimated at approximately $589 million , covering underground mine development, mining equipment, surface infrastructure, port facilities, utilities, and indirect costs, with contingency applied to reflect feasibility-level design maturity. Sustaining capital over the LOM is estimated at $609 million total , averaging approximately $26.5 million per year , and primarily relates to underground development, conveyor extensions, and equipment replacement.

Table 7 – Initial and Sustaining Capital Summary Table

|

Area |

Initial Capital ($M) |

LOM Sustaining ($M) |

Total ($M) |

|

Underground Mine Development & Equipment ($M) |

$203M |

$545M |

$748M |

|

Processing Plant ($M) |

$42M |

$31M |

$73M |

|

Surface Infrastructure & Port Facilities ($M) |

$132M |

$33M |

$165M |

|

Owner’s Costs & Indirects ($M) |

$134M |

$134M |

|

|

Contingency (approx. 15.1%) ($M) |

$77M |

$77M |

|

|

Total Capital ($M) |

$589M |

$609M |

$1,198M |

Note: Direct Sustaining CAPEX figures are inclusive of Indirects and Contingency

LOM Production and Cash Flow Summary

The Great Atlantic mine plan supports a long-life, consistent production profile, with no significant production variance once full ramp up is achieved.

Table 8 – LOM Production and Cash Flow Summary

|

Parameter |

Value (UFS Base Case) |

|

Life of Mine (LOM) |

24 years |

|

Total Tonnes Mined |

95.8 Mt |

|

Average Annual Steady-State Production |

4.0 Mt salt |

|

Cumulative Post-Tax Cash Flow |

$3.93 B |

|

Average Annual Post-Tax Cash Flow in Operation |

$188 M |

Sensitivity Analysis

The Project economics are most sensitive to salt price, capital costs, and operating costs assumptions. Sensitivity testing indicates that the Updated Feasibility Study maintains robust economics across a wide range of assumptions.

Table 9 – Economic and Sensitivity Analysis

|

Sensitivity Variance |

Sensitivity Value |

Post-Tax NPV₈ |

Post-Tax IRR |

|

|

(%) |

(By Row) |

($M) |

(%) |

|

|

2025 Salt Price Sensitivity |

(10%) |

$73.50 |

$474M |

16.9% |

|

0% |

$81.67 |

$920M |

21.3% |

|

|

10% |

$89.84 |

$1,483M |

25.0% |

|

|

CAPEX Sensitivity ($) |

(10%) |

$530M |

$963M |

22.9% |

|

0% |

$589M |

$920M |

21.3% |

|

|

10% |

$649M |

$891M |

20.2% |

|

|

OPEX Sensitivity ($/t) |

(10%) |

$19.80/t |

$973M |

22.0% |

|

0% |

$22.00/t |

$920M |

21.3% |

|

|

10% |

$24.20/t |

$881M |

20.9% |

Even under downside scenarios, the Project demonstrates positive economics and resilience, highlighting its strategic competitive positioning in the North American road salt market.

Market Opportunity

North America consumes over 25 million tonnes of road salt annually, a significant portion of which is imported, with Eastern Canada and the U.S. Northeast representing the highest concentration of demand. Regional supply challenges, combined with increasing winter severity and aging supply bases, create a strategic opportunity for Great Atlantic to deliver reliable, high-purity supply into these critical markets.

Permitting and Regulatory Approvals

The Great Atlantic Salt Project is advancing within a well-defined permitting framework under the Government of Newfoundland and Labrador.

-

Environmental Assessment (EA): Conditionally released from the provincial EA process in 2024, establishing government approval to advance the Project.

-

Early Works Development Plan: Approved in 2025, enabling shovel-ready commencement of site preparation, civil works, and other enabling infrastructure.

-

Capital Development Plan: To be submitted following completion of detailed engineering, covering underground mine development, processing, and port facilities.

-

Commercial Production Approval: The final stage permit, aligned with commissioning of mine and port facilities.

The permitting pathway for Great Atlantic is clear, with major approvals in place and a structured process established for capital development and eventual production.

Next Steps

Atlas Salt will advance the Project through:

-

NI 43-101 Technical Report Filing: Submission of the Updated Feasibility Study Technical Report within 45 days.

-

Financing Discussions: Continued engagement with project lenders, strategic offtake partners, and equity participants to advance funding solutions.

-

Detailed Engineering and Procurement: Progression of engineering design and procurement packages in alignment with the UFS.

-

Stakeholder and Community Engagement: Ongoing consultations with local communities, Indigenous groups, and stakeholders to ensure alignment and transparency.

For further information and ongoing updates, please visit https://atlassalt.com .

Qualified Persons

This news release describes an updated Mineral Resource estimate, a feasibility study and cash flow, based upon geological, engineering, technical and cost inputs developed by SLR Consulting (Canada) Ltd. A National Instrument 43-101 Technical Report (NI 43-101) will be filed on SEDAR within 45 days. The technical information in this news release has been prepared in accordance with the Canadian regulatory requirements set out in NI 43-101 and reviewed and approved by Pierre Landry, P.Geo., David M. Robson, P.Eng., MBA, Lance Engelbrecht, P.Eng., Derek J. Riehm, M.A.Sc., P.Eng., and Graham G. Clow, P.Eng. each of whom is a “qualified person” under National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”).

About Atlas Salt

Atlas Salt is developing Canada’s next salt mine and is committed to responsible and sustainable mining practices. With a focus on innovation and efficiency, the company is poised to make significant contributions to the North American salt market while upholding its values of environmental stewardship and community engagement.

For information, please contact:

Jeff Kilborn, CFO & VP Corporate Development

investors@atlassalt.com

(709) 275-2009

We seek safe harbour.

Cautionary Statement

This news release contains “forward-looking information” and “forward-looking statements” (collectively, “forward-looking information”) within the meaning of applicable Canadian securities laws, including the policies of the TSX Venture Exchange. All statements in this release, other than statements of historical fact, are forward-looking information. Forward-looking information is often identified by words such as “anticipates,” “believes,” “expects,” “intends,” “plans,” “estimates,” “may,” “could,” “would,” “will,” “potential,” “opportunity,” “strategy,” “target,” or similar expressions and variations, and include, without limitation, statements with respect to: the results, assumptions, and conclusions of the Updated Feasibility Study for the Great Atlantic Salt Project, including projected NPV, IRR, payback, capital and operating costs, production rates, mine life, cash flows, and economics; the anticipated timing and results of permitting, approvals, engineering, financing, procurement, and construction activities; expectations regarding market demand for road salt in North America, pricing assumptions, and strategic positioning of the Project; the ability to secure project financing and offtake arrangements on acceptable terms; the expected benefits of technical enhancements, mining methods, and logistics improvements; plans for stakeholder, Indigenous, and community engagement; and future exploration, development, and production activities

Forward-looking information is based on the Company’s current expectations, estimates, assumptions, and beliefs as of the date of this release, which include, but are not limited to: assumptions regarding commodity prices and demand for road salt; exchange rates; the accuracy of mineral reserve and resource estimates; the ability to obtain permits, regulatory approvals, and financing on acceptable terms; anticipated capital and operating costs; availability of labour, equipment, and services; compliance with environmental, health, and safety laws; and general business, economic, and market conditions.

Forward-looking information involves known and unknown risks, uncertainties, and other factors that may cause actual results or events to differ materially from those expressed or implied by such forward-looking information. These risks and uncertainties include, but are not limited to: risks relating to the accuracy of mineral reserve and resource estimates; risks inherent in the feasibility study process and that the Project economics may not be realized; operating and technical risks associated with underground mining and salt production; risks related to permitting, environmental regulation, and community relations; the ability to raise sufficient financing on acceptable terms; volatility in commodity prices, input costs, and exchange rates; risks related to construction schedules and cost overruns; risks related to third-party contractors and service providers; political, regulatory, and legal risks; and general business and market conditions. Additional information regarding the Company, including risk factors that may affect its business and operations, is available within the Company’s continuous disclosure documents within the Company’s profile on SEDAR+ at www.sedarplus.ca .

Readers are cautioned not to place undue reliance on forward-looking information. The forward-looking information contained in this news release is made as of the date hereof, and Atlas Salt disclaims any obligation to update or revise such information, whether as a result of new information, future events, or otherwise, except as required by applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in TSX Venture Exchange policies) accepts responsibility for the adequacy or accuracy of this release.

U.S. Securities Law Disclaimer

This news release does not constitute an offer to sell or a solicitation of an offer to buy any securities in the United States. The securities of Atlas Salt have not been and will not be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”), or any state securities laws, and may not be offered or sold within the United States or to, or for the account or benefit of, U.S. persons unless registered under the U.S. Securities Act and applicable state securities laws or pursuant to an exemption therefrom.

Non-IFRS Financial Measures

This news release contains references to certain financial measures such as “EBITDA,” “Operating Cashflow,” “Free Cashflow,” and “Return on Capital Employed (ROCE)” which are not recognized measures under International Financial Reporting Standards (“IFRS”). These non-IFRS measures do not have standardized meanings prescribed under IFRS and therefore may not be comparable to similar measures presented by other issuers.

-

EBITDA / Operating Cashflow – In this release, EBITDA is closely approximated by Operating Cashflow, which is defined as net revenues less cash operating costs before interest, taxes, depreciation, and amortization. Management believes this measure is useful in evaluating the Project’s ability to generate cash from operations.

-

Free Cashflow – Defined as post-tax cashflow after deducting initial and sustaining capital expenditures. Management uses this measure to assess the cash potentially available for reinvestment, debt repayment, or distribution to shareholders.

Management believes that these measures provide meaningful information to investors and analysts in assessing the economic potential and financial performance of the Great Atlantic Salt Project. However, they should not be considered in isolation, as a substitute for, or superior to, measures prepared in accordance with IFRS.

SOURCE: Atlas Salt Inc.

View the original press release on ACCESS Newswire